|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

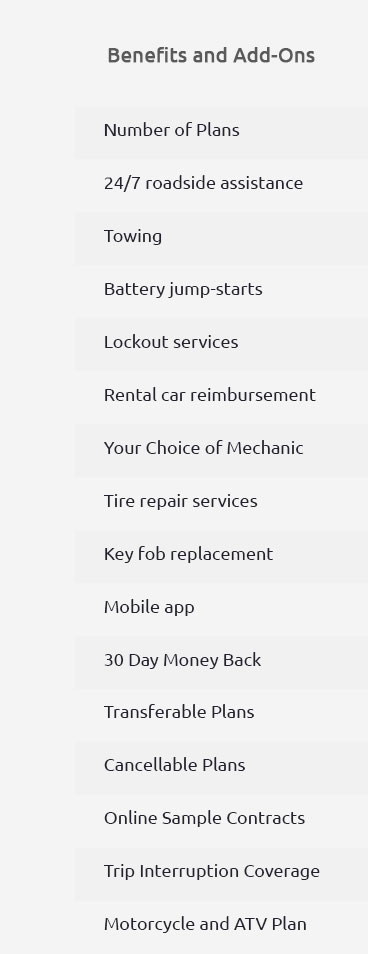

Auto Repair Insurance Programs: A Comprehensive Coverage GuideFor U.S. consumers, understanding auto repair insurance programs is crucial for protecting your vehicle and your finances. With rising repair costs, these programs offer peace of mind by covering unexpected expenses and ensuring your car is always ready for the road. What Are Auto Repair Insurance Programs?Auto repair insurance programs, often referred to as extended auto warranties, are plans that cover the cost of specific repairs after the original manufacturer’s warranty expires. They are designed to mitigate the high costs associated with auto repairs, providing a safety net for vehicle owners. Benefits of Auto Repair InsuranceThese programs are more than just financial safety nets. Here are some key benefits:

What’s Covered?Coverage can vary widely between providers. However, most plans typically include:

For a more customized plan, consider exploring a preferred car warranty that matches your specific needs. Choosing the Right ProgramFactors to ConsiderWhen choosing an auto repair insurance program, consider these important factors:

In locations like California, where commuting is common, having comprehensive coverage can be particularly beneficial. Additionally, if you own a truck, a truck warranty comparison can help you find the best options tailored to your vehicle type. Frequently Asked QuestionsWhat is the average cost of an auto repair insurance program in the U.S.?The cost typically ranges from $350 to $700 annually, depending on the level of coverage and the provider. Are there any exclusions in auto repair insurance programs?Yes, most programs do not cover routine maintenance, wear-and-tear items, or damages from accidents. Can I purchase a plan if my car is older?Many providers offer plans for older vehicles, but the terms and coverage might be limited compared to newer models. Choosing the right auto repair insurance program can provide significant financial and emotional benefits. Evaluate your options carefully to ensure you select a plan that best suits your needs and enjoy the peace of mind that comes with knowing your vehicle is protected. https://www.libertymutual.com/vehicle/auto-insurance/coverage/car-repair-insurance

The Lifetime Repair Guarantee is a car repair insurance that eliminates the hassle of fixing your car after an accident. https://amtrustfinancial.com/industries/auto-repair

AmTrust provides coverage tailored to the needs of auto repair and mechanic shops. Our auto repair insurance policies can be written as a package or monoline. https://www.aegisifs.com/auto-repair-insurance

This type of insurance covers a variety of businesses, including automobile dealers, repair garages, service stations, storage garages, parking lots, valet ...

|